My editors thought the best present they could give me this holiday season was a bitcoin, the increasingly popular form of digital currency that uses cryptography instead of government regulation to validate transactions. It was a kind gesture, and it made me very worried about my reputation at the office.

But never one to turn down free money, I happily obliged. If I secured a bitcoin, I had to make one promise: to use a bitcoin and only a bitcoin to purchase Christmas gifts for my family and friends.

Created in 2009, bitcoin is a libertarian’s dream currency: unregulated and pseudonymous for users. Mocked by the business press as a shady fad, bitcoin saw its unit value pass that of an ounce of gold on the day after Thanksgiving, hitting $1,242, and peaking at a 9,000% gain for the year.

Despite its fringe reputation, bitcoins have been jingling in some distinguished pockets lately. Billionaire showman Richard Branson announced recently that he’ll accept them as payment for flights into space, and outgoing Federal Reserve Chairman Ben Bernanke praised digital currencies like the bitcoin in a recent letter to the Senate.

So my editors did something most young reporters only dream of: they wired me a bunch of money and trusted me to not skip the country with it. Then they ushered me into the bitcoin marketplace just as the holiday shopping season got under way.

There are some benefits to doing your holiday shopping using bitcoins. For one thing, bitcoins are a far more secure method of payment than your credit card, so if you use them, there’s little reason to fear identity thieves as other shoppers might.

“It keeps your personal information hidden, so it’s a much more secure way of shopping for presents online,” says Stephanie Wargo of BitPay, a company that helps merchants use the currency.

And there are thousands of vendors online who accept bitcoins as payment.

The independent jewelry shop Cisthene, run by husband-and-wife duo Jen and Dennis Altman of Asheville, N.C., year as a fee-free alternative to credit card payments. So far, bitcoin sales have been minimal. “We’ve had three orders in six months,” Dennis told me.

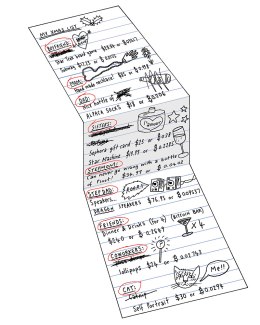

Make that four: I purchased a leatherwrapped crystal necklace (.0998 BTC) for my mom.

Next, Fred Ersham of Coinbase, a leading digital wallet company, recommended I try BitDazzle, which he described as “an Etsy for bitcoin.”

“They have literally so many different things,” he assured me.

He was right. You can buy everything from furniture to hand-sewn cloth diaper covers there.

The more purchases I made, the easier it got. I bought socks made out of Alpaca wool for my dad from a farm in Massachusetts (.0206 BTC). For my stepmom, I bought a bottle of Pinot Grigio (.0402 BTC) from City Wine Cellar, a Staten Island wine store that accepts bitcoin for online purchases. I logged back onto BitDazzle and got my little sisters a machine that projects stars onto the walls and ceiling (.09537 BTC). For my cat (what, you don’t buy Christmas presents for your pets?) I commissioned a portrait (.0294 BTC) from a Vancouver artist named Cliff Blank.

“Vancouver is the first place in the world to have a bitcoin ATM,” Blank said. “So it’s really going full steam here.”

Buying online was pretty easy, but what would happen when I tried to buy things with bitcoins in the real world? Turns out, it’s not as simple.

On a recent rainy night, I took some friends and co-workers to a New York City bar named EVR, co-owned by bitcoin entrepreneur Charlie Shrem. The 24-year-old has made millions off the digital currency. His bar is the only one in Manhattan that accepts bitcoins. Shrem’s girlfriend Courtney is a waitress there, and she set us up with plates of wings and fries and glasses of champagne and vodka sodas (.2649 BTC).

EVR was fun. Paying at EVR was not. Thanks to the complicated digital transaction process, it took 20 minutes to get bitcoin change out of one digital wallet and into another equipped with a mobile app–a lot of trouble compared with just forking over your Visa. (Coinbase, where I kept my bitcoins, had its app pulled from the iTunes store a few weeks before.) Scanning the QR code was easier, though. Finally, the payment was transferred.

There is another downside: very few brick-and-mortar stores actually accept bitcoins today. That’s how I ended up at Subway in Allentown, Pennsylvania, over Thanksgiving break. The guy making the sandwiches accidentally rang us up for 17.23 bitcoins—over $20,000—before realizing it should be $17.23 instead. Crisis averted!

So what did I learn? There are some reasons to think bitcoins could be the future—especially if someone like Bernanke is giving them a closer look. But for now, I’ll probably stick with cold hard cash—unless, that is, my editors are buying.